All Categories

Featured

State Ranch agents sell everything from home owners to car, life, and various other preferred insurance products. It's very easy for representatives to pack solutions for discounts and simple strategy monitoring. Lots of customers enjoy having actually one trusted agent take care of all their insurance policy requires. State Farm supplies global, survivorship, and joint global life insurance policy policies.

State Ranch life insurance coverage is normally conservative, supplying secure choices for the typical American family members. However, if you're searching for the wealth-building opportunities of universal life, State Ranch lacks affordable alternatives. Read our State Farm Life insurance policy review. Nationwide Life Insurance markets all kinds of global life insurance: global, variable global, indexed universal, and universal survivorship policies.

However it doesn't have a strong visibility in various other economic products (like global strategies that open up the door for wealth-building). Still, Nationwide life insurance policy strategies are very available to American family members. The application process can additionally be more convenient. It assists interested celebrations get their means of access with a trusted life insurance policy strategy without the far more complicated conversations about financial investments, economic indices, etc.

Also if the worst occurs and you can not obtain a bigger plan, having the security of a Nationwide life insurance plan could change a purchaser's end-of-life experience. Insurance coverage companies make use of clinical tests to assess your risk course when using for life insurance policy.

Purchasers have the alternative to change prices each month based on life conditions. Of course, MassMutual offers amazing and potentially fast-growing chances. However, these plans have a tendency to do finest over time when early down payments are greater. A MassMutual life insurance policy agent or economic advisor can help buyers make plans with area for changes to meet temporary and long-term monetary objectives.

Cost Universal Life Insurance

Read our MassMutual life insurance policy testimonial. USAA Life Insurance Policy is recognized for providing affordable and detailed financial products to armed forces participants. Some customers might be amazed that it offers its life insurance policy plans to the general public. Still, army members delight in special benefits. As an example, your USAA plan features a Life Event Choice rider.

VULs feature the greatest threat and one of the most possible gains. If your policy doesn't have a no-lapse assurance, you might also shed protection if your money worth dips below a certain threshold. With so much riding on your financial investments, VULs require constant focus and upkeep. It may not be a terrific alternative for individuals that merely desire a death advantage.

There's a handful of metrics by which you can evaluate an insurance business. The J.D. Power customer complete satisfaction ranking is a good alternative if you desire a concept of how customers like their insurance coverage policy. AM Best's economic stamina rating is an additional essential statistics to consider when selecting a global life insurance policy business.

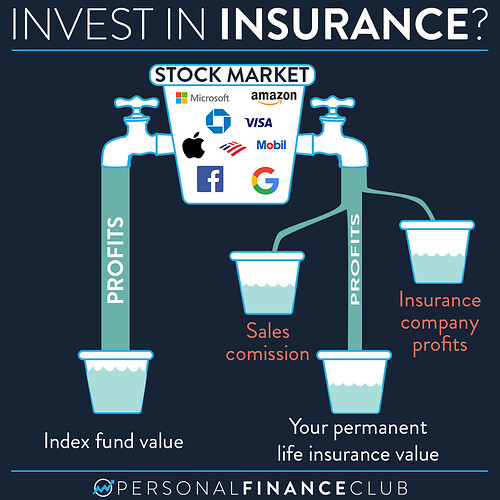

This is specifically crucial, as your cash money worth expands based upon the investment options that an insurer offers. You need to see what financial investment choices your insurance supplier deals and contrast it versus the goals you have for your plan. The most effective way to discover life insurance policy is to gather quotes from as many life insurance policy companies as you can to comprehend what you'll pay with each policy.

Latest Posts

Indexed Universal Life Insurance Complaints

Universal Life Insurance Vs Term Life

Disadvantages Of Indexed Universal Life Insurance